The Fund protecting investors from market volatility

Promoted by APSEC Funds Management

The looming spectre of inflation

The trillions of dollars of ongoing monetary and fiscal support propping up economies throughout the pandemic are now creating heightened inflationary pressures, forcing central banks to start curtailing stimulus and raise interest rates sooner than planned.

As inflation in the US hit a near 40-year high in December, the U.S. Federal Reserve has signalled monetary tightening at a much faster pace, with a recent Reuters survey of leading economists now forecasting at least 3 interest rate hikes in 2022 and 3 more in 2023.^

Consequently, the past 6 months have been a turbulent period for share market investors, with the S&P/ASX 200 down substantially from its August 2021 highs, losing -3.8% for the 6 months ending January 31, 2022.

Through this challenging period, the Atlantic Pacific Australian Equity Fund (APAEF’s) focus on proactive risk management has seen the Fund return 5.0%, an excess return of 8.8% over the S&P/ASX 200.*

Long-term downside protection

The APAEF is substantially differentiated from most Australian funds, as a long/short (hedge) fund which typically buys or short sells Australian listed securities and S&P/ASX200 futures contracts, offering downside protection, while still providing strong upside returns.

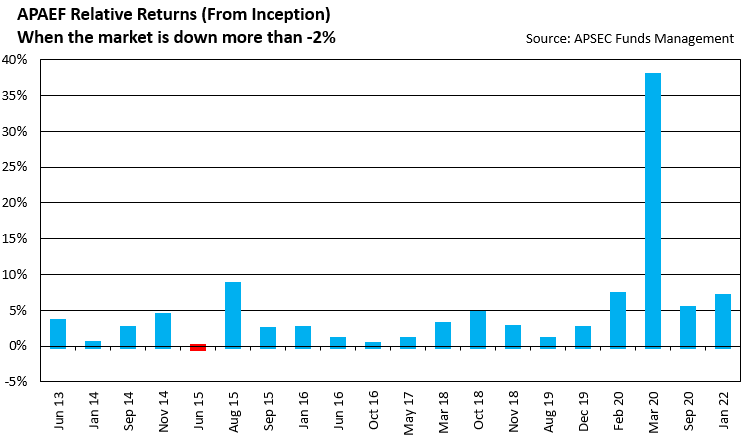

As you can see in the chart below, since inception in June 2013, the APAEF has provided positive relative returns in all but 1 period when the S&P/ASX 200 has fallen by -2% or more, showing the long-term effectiveness of these risk mitigation strategies.

Higher interest rates could cause sustained downward pressures on market pricing, as investors look to improving bond yields and other safe haven assets.

What protection strategies do you have for your personal or client portfolios?

Learn more about the APAEF’s unique investment methodology.

Click through to read more about the APAEF’s hedging and trading strategies, and how the Fund can provide strong diversified returns with low correlation and less volatility than the S&P/ASX 200.

Important information

* Fund Returns are prepared on a redemption unit price basis after management and performance fees inclusive of GST. Distributions are assumed to be re-invested at the mid unit price. Individual tax is not taken into account in deriving Fund Returns. In calculating the NTA, the Atlantic Pacific Australian Equity Fund (“Fund”) asset values have been calculated using unaudited price and income estimates for the month being reported. Past performance is not indicative of future performance.

Equity Trustees Limited (Equity Trustees) ABN 46 004 031 298 AFSL 240975 is the Trustee for the Atlantic Pacific Australian Equity Fund (ARSN 158 861 155) (Fund). Equity Trustees is a subsidiary of EQT Holdings Limited ABN 22 607 797 615, a publicly listed company on the Australian Securities Exchange (ASX: EQT). APSEC Funds Management Pty Ltd (APSECFM) ACN 152 440 723 is the Investment Manager of the Fund and a Corporate Authorised Representative 411859 of APSEC Compliance and Administration Pty Limited ABN 30 142 148 409 AFSL 345443. This publication has been prepared by APSECFM to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Equity Trustees, APSECFM, nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement (PDS) before making a decision about whether to invest in this product.