Holding life insurance in super: is it worth it?

Claiming deductions for life insurance premiums is often used as an argument for holding life insurance within super; however, it may not always the be best strategy for the client.

Insurance within SMSFs – what’s changed?

From 1 July 2011

From 1 July 2011, the full deduction for insurance premiums within super funds was modified. If it was solely a life policy the 100 per cent deduction remained available. If it was just a TPD policy a 67 per cent deduction was applied to the premium. If the insurer bundled the 2 types of insurance together the super fund could claim 80 per cent of the premium in its tax return.

From 7 August 2012

Considering the exponential growth in the setup of SMSFs in recent years, and as a result of the Cooper Review in 2010, the government was concerned that SMSFs were underinsured, so it became compulsory that trustees of super funds were required to consider insurance for their members. This generally speaking, requires the provision of insurance for members of the superannuation fund to be considered by the trustee within the investment strategy of the fund.

From 1 July 2014

New regulations limited the types of insurance that can be held within your superannuation fund, subject to some transitional provisions. From 1 July 2014 ‘own occupation’ life insurance policies were no longer able to be held by superannuation funds. This was to avoid the situation where the insured member may suffer an injury that entitles them to a payout of insurance, but the injury may not have met the more onerous definition of permanent incapacity under the condition of release rules, and the payout was trapped inside the superannuation fund.

New policies of insurance cover held within superannuation funds now need to be consistent with the conditions of release such as death, terminal medical condition, permanent incapacity and temporary incapacity. Policies already held prior to 1 July 2014 are still allowed.

Insurance – you buy it to receive a payout in a difficult time

Life insurance is taken out to try and assist our loved ones financially, when we die sometime in the future. We like to think that our dependents are taken care of, especially if our departure is sudden and even more so if it’s a traumatic event, such as a car accident etc. But how would you or your clients feel if the government took an extra 15 per cent of the insurance payout at the time? Not Happy Jan!

This comes about if deductions have been claimed on the premiums for a life policy and the lump sum insurance payout goes to a non-tax dependant. You might say, that’s ok, I only have dependants, but did you know that children can be classed as a non-tax dependant?

To claim or not to claim – is that the question?

S307-290 ITAA – where a non-tax dependant receives a lump sum payment and if a deduction has been claimed on the insurance premiums, an untaxed element is generated. This untaxed element is taxed at an additional 15 per cent + Medicare levy on the taxable death benefit.

Calculation of the untaxed element:

• Untaxed Element = taxable component of the benefit less the taxed element,

• Taxed Element = Lump Sum * Service Days/ (Service days + Days to Retirement) reduced by any tax free component.

• Days to retirement is the days from date of death to their retirement date (65yo).

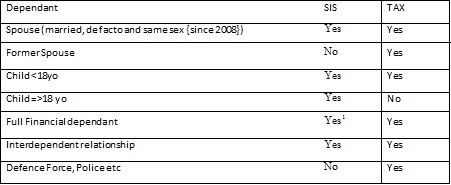

Now, this extra 15 per cent only occurs if the death benefit is paid to a non-tax dependant. So who is a dependant and who is a non-tax dependant? There is a slight difference in definitions between SIS legislation and tax legislation, remembering that the SIS legislation tells us who a death benefit can be paid to and the tax legislation tells us how it will be taxed.

[1] Including dependent adult child, full or partial financial dependency

So from the above table, an adult child who is not fully financially dependent on the deceased i.e. they would not be financially able to support their basic needs without the support of the deceased at the time of death, would not qualify for a tax free lump sum death benefit.

How to avoid the non-tax dependant tax

If you only have tax dependants then a lump sum death benefit will be tax free.

If you have non-tax dependants:

• For cash flow reasons, you may still prefer your super fund to hold the life insurance policy, so that the premiums are not coming out of your everyday finances. Then if you wish to avoid the extra 15 per cent tax, don’t claim the tax deduction for the premiums.

• What if you have been claiming the deduction while your children are minors, then they turn 19 and are no longer financially dependent on you? Can you just stop claiming the deduction at that point? In a word, no. A new policy would need to be put in place and the deductions on the new policy not claimed.

• Hold the life insurance policy outside of super, the premiums will not be deductible, but the insurance payout is tax free to non-tax dependents.

Get qualified, licenced advice

There are quite a few factors to consider for your clients when it comes to their insurance policies and obtaining the best structure for their particular situation. We strongly recommend speaking with a licenced financial adviser.

Catherine Price, principal auditor, TABS Super Fund Auditors